60+ banks lost money during the mortgage default crisis because

Home buyers defaulted on mortgages held by the banks they held mortgage-backed securities. Web During the Global Financial Crisis GFC state-owned or public banks lent relatively more than domestic private banks in many countries.

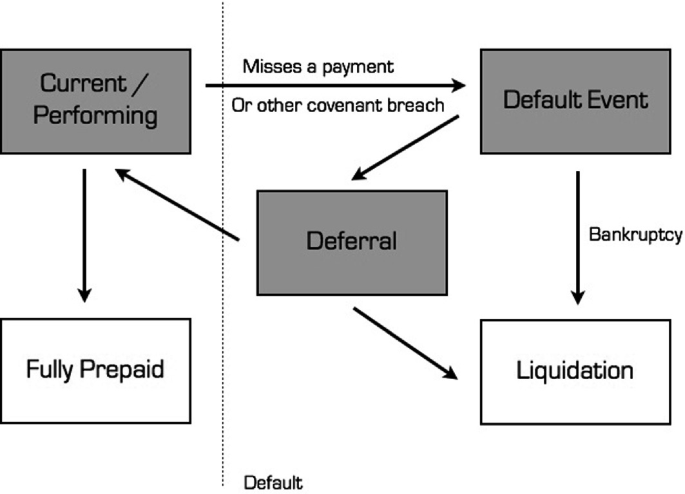

Pdf Estimating Default Probabilities Of Cmbs Loans With Clustering And Heavy Censoring

They held a mortgage-backed securities.

. And 3 the resolution of the. Web banks for deposit insurance coverage both before and during the crisis what changes were made and what extraordinary measures were required. Web Banks offered easy access to money before the mortgage crisis emerged.

Web banks lost money during the mortgage default crisis because. Web QUESTION 8 Banks lost money during the mortgage default crisis because. The prime players were banks hedge funds investment.

Of defaulted loans to investors in the mortgage-backed securities b. Web The ultimate cause of the subprime mortgage crisis boils down to human greed and failed wisdom. 2 Borrowers got into high-risk mortgages such as option-ARMs and they qualified for.

- they held mortgage-backed securities they. - of defaulted loans to investors in mortgage-backed securities. Web Banks lost money during the mortgage default crisis because.

How 60 Startups Are Disrupting Retail And Commercial Banking Around The World

Overview Of Loan Portfolio Analysis Springerlink

Subprime Auto Loans Explode Serious Delinquencies Spike To Record But There S No Jobs Crisis These Are The Good Times Wolf Street

Rbnz Banks Resilient To All But The Most Severe Scenarios Interest Co Nz

Financial Crisis Creditor Debtor Conflict And Populism Gyongyosi 2022 The Journal Of Finance Wiley Online Library

Missing 65 Trillion In Derivatives Dollar Debt Sparks Concern Bloomberg

Fossil Fuel Production Is Reaching Limits In A Strange Way Our Finite World

Subprime Mortgage Crisis Wikiwand

Staggering Loss Of Black Wealth Due To Subprime Scandal Continues Unabated The American Prospect

Czech Republic Staff Report For The 2018 Article Iv Consultation In Imf Staff Country Reports Volume 2018 Issue 187 2018

The Fed Stopped Buying Mbs Today Wolf Street

Economic Impacts Of The Covid 19 Crisis Evidence From Credit And Debt Of Older Adults Journal Of Pension Economics Finance Cambridge Core

Mortgage Rates Spike Home Sales Drop For 7th Month And Suddenly Here Come The New Listings Wolf Street

Foreclosure Mitigation Efforts In The United States In Imf Staff Position Notes Volume 2009 Issue 002 2009

Big Banks Paid 110 Billion In Mortgage Related Fines Where Did The Money Go Wsj

Housing Market Under Covid 19 Regular Folks Retreat Foreign Investors Blocked Large Us Investors Gone Ibuyers Frozen Wolf Street

Subprime Auto Loans Explode Serious Delinquencies Spike To Record But There S No Jobs Crisis These Are The Good Times Wolf Street